I know this article comes a tad bit late for tax season this year. However, it comes at the perfect time to answer some questions for the coming year. Tax time is no fun for anyone. It’s not fun when you’re rich and it’s really not fun when you’re broke. One thing that makes this time of year particularly tough for actors is that very few of them understand how to manage their taxes. I’m hoping to help in some small way here today.

I know this article comes a tad bit late for tax season this year. However, it comes at the perfect time to answer some questions for the coming year. Tax time is no fun for anyone. It’s not fun when you’re rich and it’s really not fun when you’re broke. One thing that makes this time of year particularly tough for actors is that very few of them understand how to manage their taxes. I’m hoping to help in some small way here today.

First things first, no matter how much money you are making as an actor/waiter/temp/other, you need to reframe the way you think about tax time. It’s really easy to forget about it for most of the year, but you are doing yourself a disservice by not keeping adequate records. This is your business. You’ve heard it said that, as an actor, you are the CEO, CFO, Head Marketing Director, etc. for your business. You need to treat it as such. Let’s get to it.

Log Your Income –

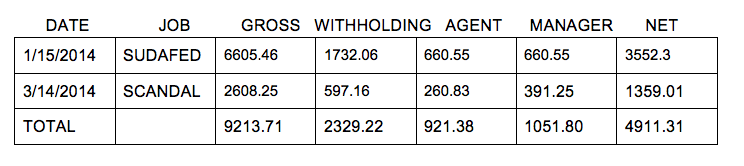

Set up a spreadsheet in Google Drive. It’s free and you can access it from anywhere, so no excuses. When you receive a payment, make sure to log:

It’s a pain in the booty, but you’ll be thankful when it comes time to do your taxes and you know exactly how much you paid everyone.

Keep Your Receipts –

Keep the physical receipts for everything. I thought it was okay to just keep my bank statements. I was wrong. I don’t mean to be scary, but actors are audited up to five times more frequently that “regular” folk. And if that day comes, you will need the physical receipts to take the deductions.

Track your 1099 income –

If you didn’t fill out a W-4 on set, or if this is a non-union job, chances are that this is 1099/independent contractor work. It may be super sexy to get that $10,000 check into your hands without Uncle Sam taking his cut first. But beware! Uncle Sam always gets his cut! Someone is gonna come a-knockin’ for at least 30% of your 1099 income around tax time. Do yourself a favor and DON’T SPEND IT. Put that money away into another account in the meantime.

If you anticipate earning a lot of 1099 income this year, it would probably behoove you to make quarterly tax payments of a couple hundred bucks each. Ew! Gross, I know. However, on April 15th when you’re already crying over shelling out that 30%, guess what’s going to happen. IRS is gonna slap you with a “late payment fee” for all of this money they should have been able to use throughout the year. Sometimes upwards of $100! Far more than the piddly 1% interest you earned on that money in your savings account. Just bite the bullet and do it!

Lastly, if you have a lot of 1099 income in a year, I recommend that you pony up the dough and go to a tax company that specializes in the performing arts. They can help you by specifically applying your deductions against the 1099 income and significantly reduce the amount you owe.

Understand Your Deductions-

There are many rumors about what actors can deduct. I’ll quickly try to address some of those here.

1. Clothes/Hair/Makeup/Nails – You may only deduct these things if they were for a specific job. And, if push comes to shove, you need to be able to prove that it was required with a written note from the employer. For example – if you are asked to have your nails done for a print job, that would count. Keep the receipt and write the job on the receipt. The criteria that the IRS uses for clothing deductions is this: If it is suitable to wear on the street, it is not a deduction. So, your chicken suit for that KFC audition? 100% deductible!

2. Medical expenses/Car expenses – YES! Keep all receipts! And, as TERRIBLE as it is, track your milage. Download a free app on your phone and just do it.

3. Meals – Any meal in which you discussed business (agents, scripts, classes) you may deduct. Make sure to write on the receipt who you met with and what you talked about.

4. Gifts for agents/managers/casting – You are allowed $25 in gifts per person, per year. Keep your receipts and write it down.

5. Your gym membership/cell phone/cable – You may deduct a percentage of these. You will be asked to calculate how much you use your phone/cable for business. I usually deduct 75% for my phone and 50% for my cable.

6. Classes – YES! 100% Deductible. Woohoo!

There are many more deductions and situations than I’ve been able to list here, but these seem to be the one’s that are argued about the most.

There is so much more to talk about on this subject. If you have any more questions, feel free to ask them here and I’ll try to help. Hopefully, these quick n’ dirty tips will help you out a little. Just remember to keep records as best you can and sock a little money away so that you’re not hurting when Uncle Sammy wants a slice.